Choosing a lender isn't the first step in becoming a homeowner

Scoring Your FICO

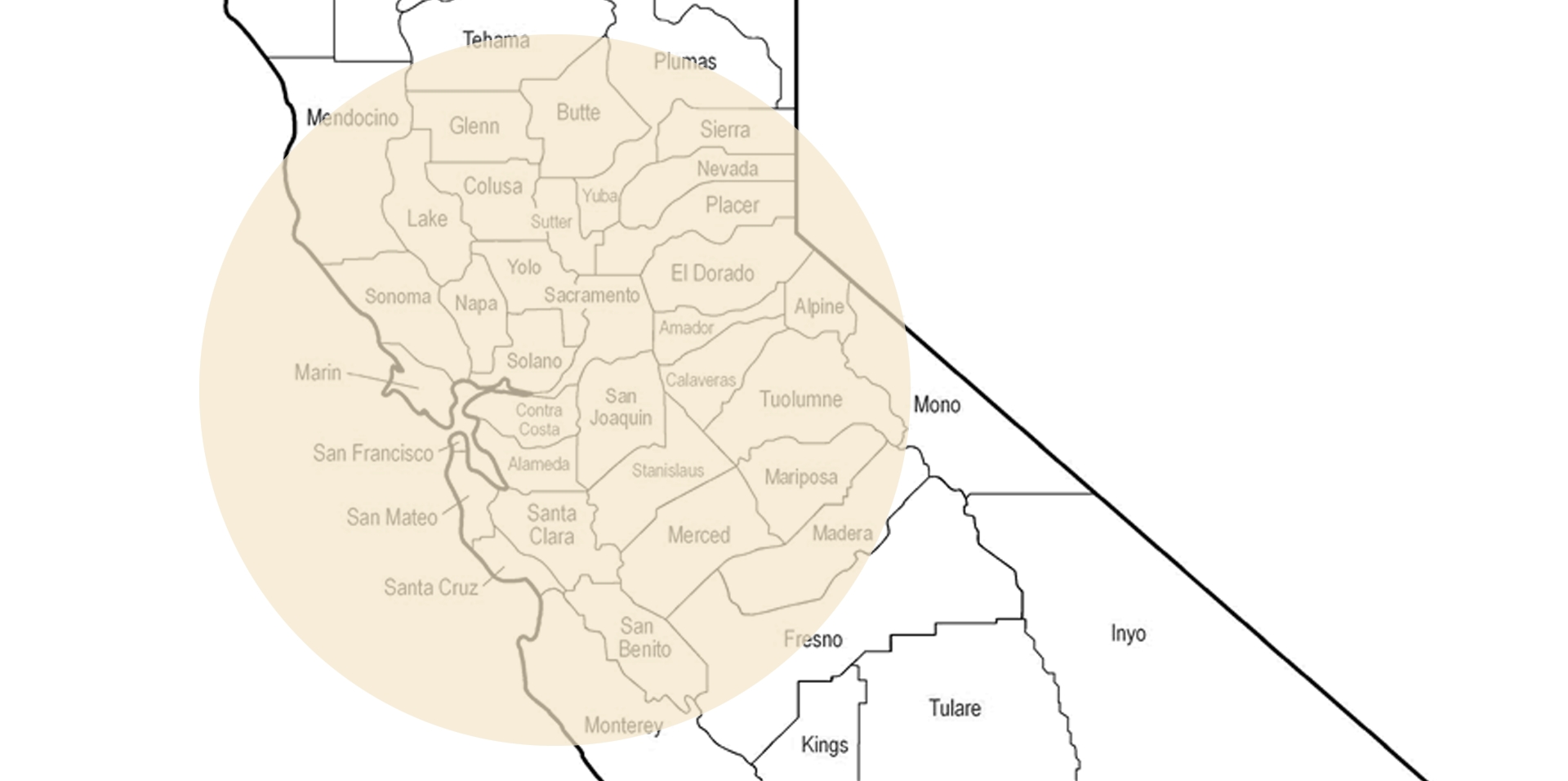

Choosing a lender isn't the first step in becoming a homeowner. In reality, the home buying process begins with your finances. Without an above average credit score, buying a house is harder and you could find yourself renting longer than you expected in the San Francisco Bay Area until your score improves.

The Fair Isaac Company calculates your FICO score on the summary of your total credit history. The score ranges from 300 to 850, with most people traditionally having a score of 600. In recent years, however, some people have seen their score drop by hundreds of points because of unemployment, delinquent credit card accounts, or credit card accounts terminated because the card didn't carry a high balance.

Some of the pieces in reviewing your FICO score include:

Types of Credit — Do you have a healthy mix of loans and credit cards?

Payment History — Do you pay your bills on time every month?

Credit to Debt Ratio — How much do you owe versus how much credit you have available?

Credit Inquiries — Do you have too many open accounts?

When you pull your credit report, you'll find that you actually have three reports. Experian, Equifax and TransUnion — three of the major credit reporting agencies — use a slightly different systems to calculate your credit rating. FICO is used by Experian. Equifax's model is called BEACON and TransUnion uses EMPIRICA. This means you have three scores, one for each bureau.

When you apply for a mortgage or any other loan, lenders want to make sure that extending a loan to you isn't a problem. Your credit score gives lenders insight into what type of borrower you'd be based solely on your credit history. Because of the shift in the economy, most home buyers should have scores in the range of 740 or higher to get a satisfactory interest rate. If your score is less than that, you can still qualify for a loan, but the interest accumulated over time could be more than double the amount of someone having a stronger FICO score.

We're used to working with all tiers of FICO scores. Call and we can help you get on the right track to the home of your dreams.

There are methods to raise your score. Improving your FICO score takes time. I know it's rare to make a significant stride change in your FICO score with quick fixes, but your score can improve in a year or two by monitoring your credit report and by using credit extended to you to raise your score, instead of ruin it. The most important thing is to know your FICO score. You'll improve your credit score by using these helpful hints:

Even out your debt. At first, this doesn't sound like a good idea. But, you don't want to have one card that is at the maximum and have your remaining cards at a zero balance. It's better to have each of your cards at an even balance than to have the most of your debt sitting on one card.

Apply for gas station cards or retail credit.

For those who have no credit or less-than-stellar credit, chain store credit cards and gas credit cards are ways to begin your credit history, increase your credit limits and stay on top of your payments, which will raise your FICO score. Just beware of keeping a high balance for more than a couple of months because these types of cards usually have a surprisingly high interest rate.

Don't let your cards get dusty.

Whether you're just getting started with credit, or if you've got older cards, be sure to use your cards to make sure your accounts stay active. But, make sure you pay them off in one or two payments.

Stay on top of payments.

Your credit score plummets with each account that goes to collections. It's where people who have recently experienced job loss see the biggest hit in their credit score. Yes, it takes longer to rebuild your credit with payment history, but it's the most reliable way to show that you're able to make payments to a bank.

Correct your credit report.

If you discover incorrect items on your credit report, contact the bureau asking that the item be removed. If you have a common name or the same name as a family member, you'll want to pay extra attention to make sure the activity reported is correct.

Now that you're better informed about credit reporting, you'll be able to successfully take the first step in owning a home, and that is improving your FICO score. Remember that when it's time to apply for a loan to purchase a house, you'll want to keep your applications within a two-week window to avoid damaging your credit score. Shopping for a mortgage can be a stress-free experience so you, too, can become a homeowner.

Get more information by visiting www.myFICO.com, Fair Isaac's informational site and you can review all of your credit reports for free each year at www.annualcreditreport.com. And, for a small payment, you can get your FICO score from each bureau on their websites: www.equifax.com, www.experian.com and www.transunion.com.

We work with all levels of credit scores and can help you step into home ownership with the best lending insitution for you.